How to File Bi-Weekly Certification Forms

(for CA Community College Part-Time Faculty)

Please read the "After Filing" section of How to File Overview. If you have not at least looked over that document, please do so before continuing.

Let the Screenshots Guide You

The information indicated in the screenshots guides you in how to fill out the forms. In most cases you should answer the questions as indicated in the figures, but, of course, you will need to provide a different answer if the answer shown does not match your own personal information or situation.

There may be specific notes below each screenshot.

Go to the EDD Website and Log In

Go to:

https://portal.edd.ca.gov/WebApp/Login

and log in.

If you cannot log in and you get a message that you are "locked out," you have a few options:

- Wait until the lock disappears (this may take an hour or so).

- Call the EDD help line at (800) 300-5616 (but it's almost impossible to get through).

- Create a new account, using a different email address (if you do this, you will not be able to reopen a claim, and you will need to file as a new claim, which takes quite a bit longer than reopening a claim).

After you log in, cLick the "UI Online" link.

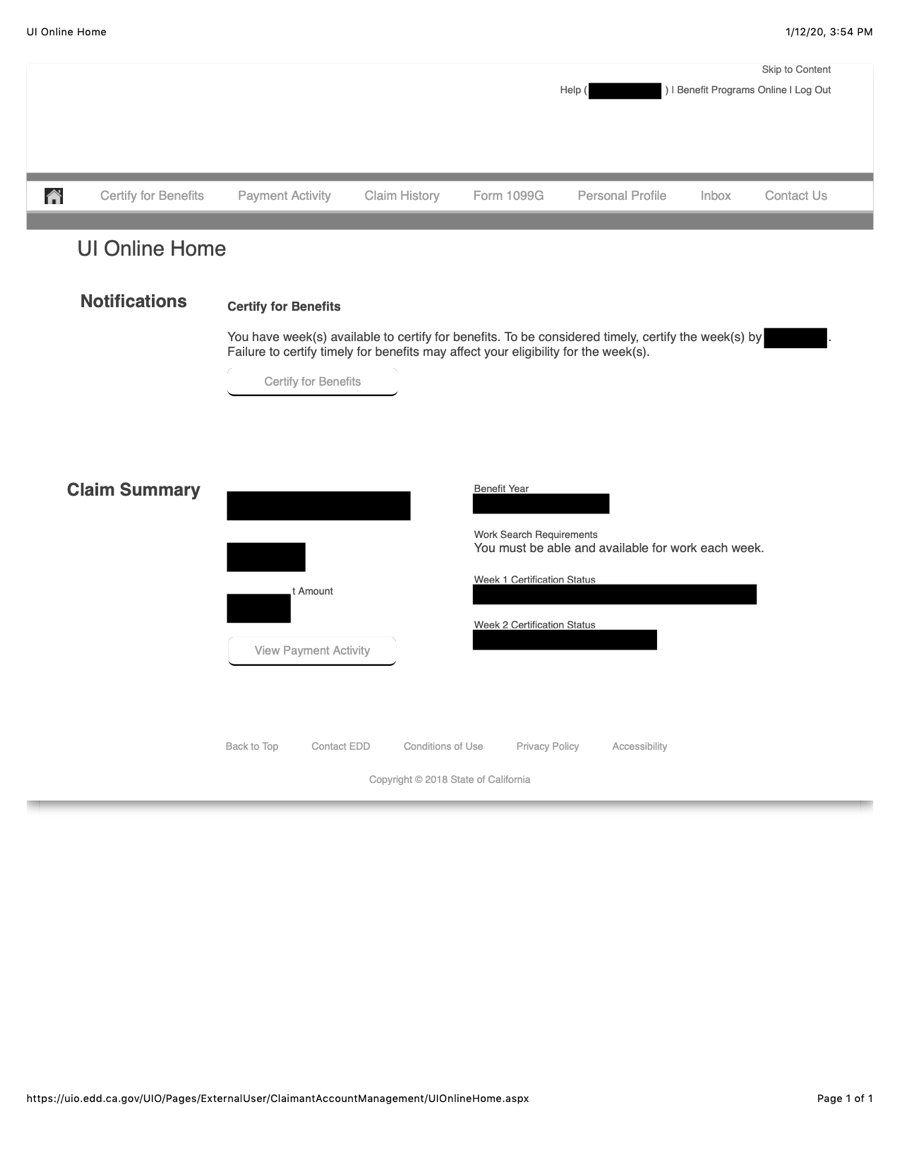

UI Online Home

Figure 1:

- After you log in you should see a button that says "Certify for Benefits." Click it. (If you do not see the button, you have no bi-weekly certification forms to file.)

File Your Bi-Weekly Certification

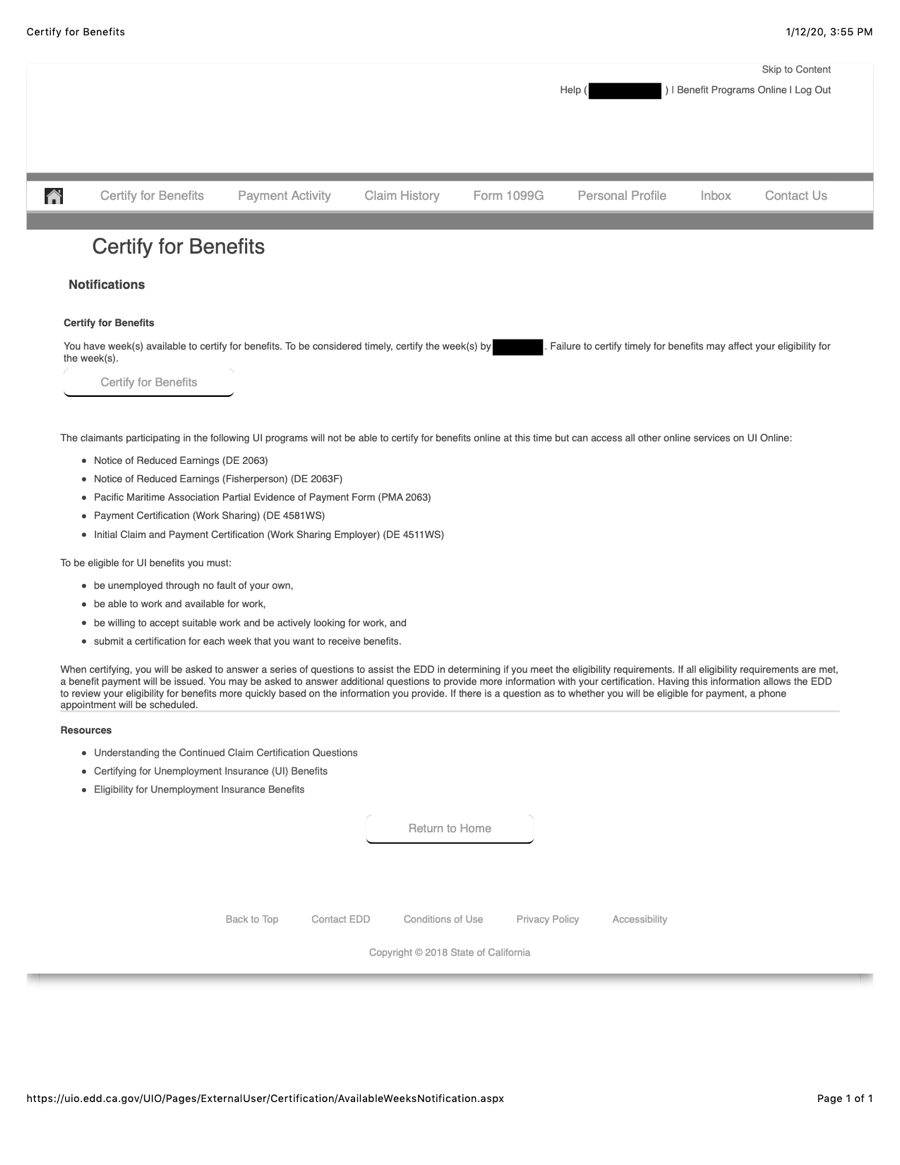

Certify for Benefits

Figure 2:

- Click the "Certify for Benefits" button.

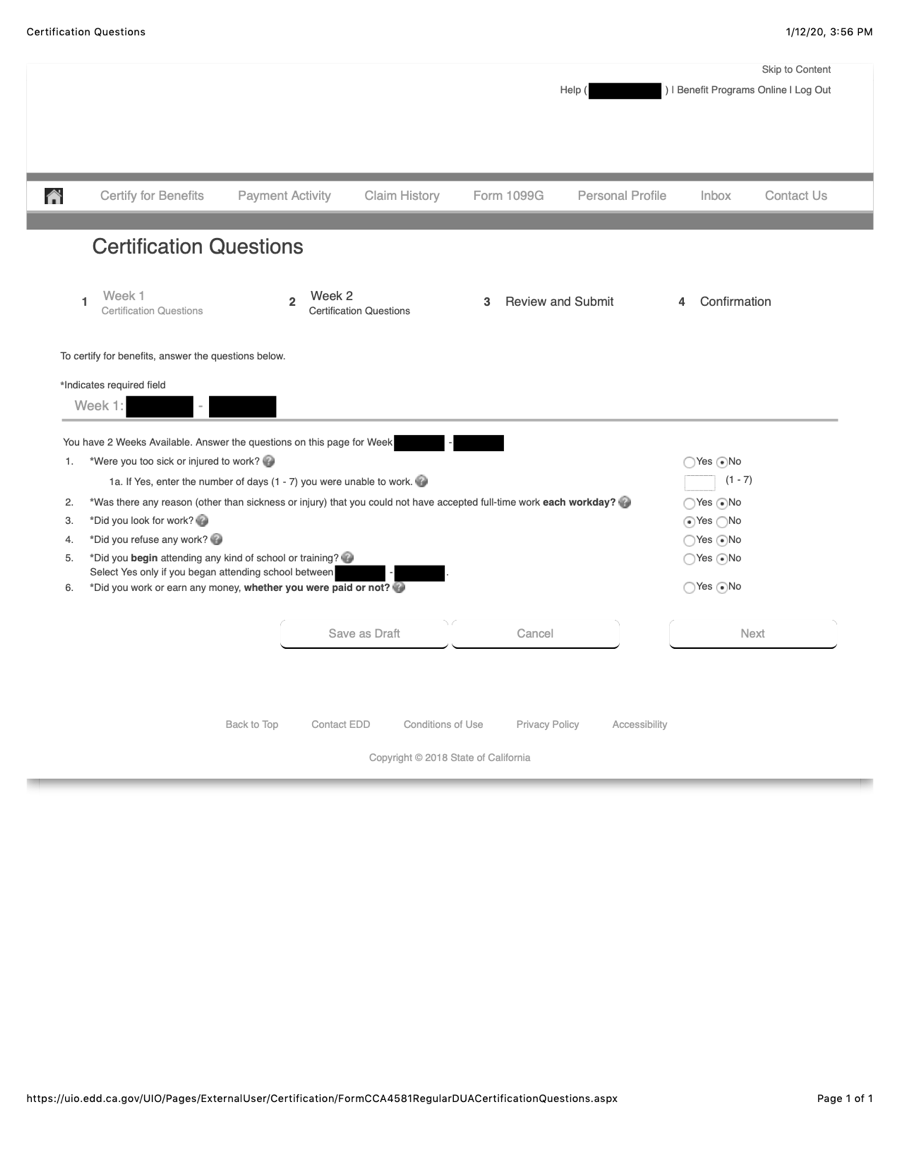

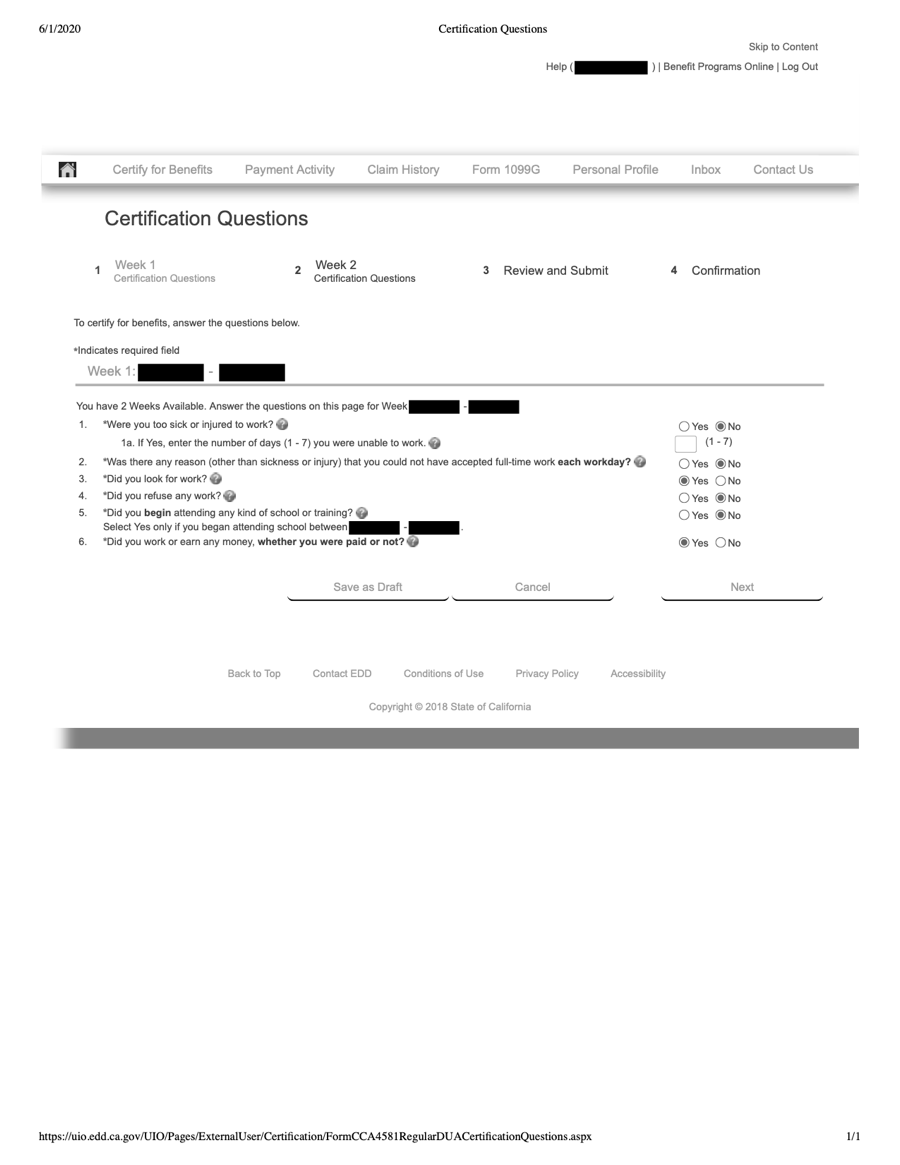

Certification Questions (for Week 1)

Figure 3:

- Assuming you did not work in Week 1, enter the information as shown above.

- If you did work during Week 1, see below.

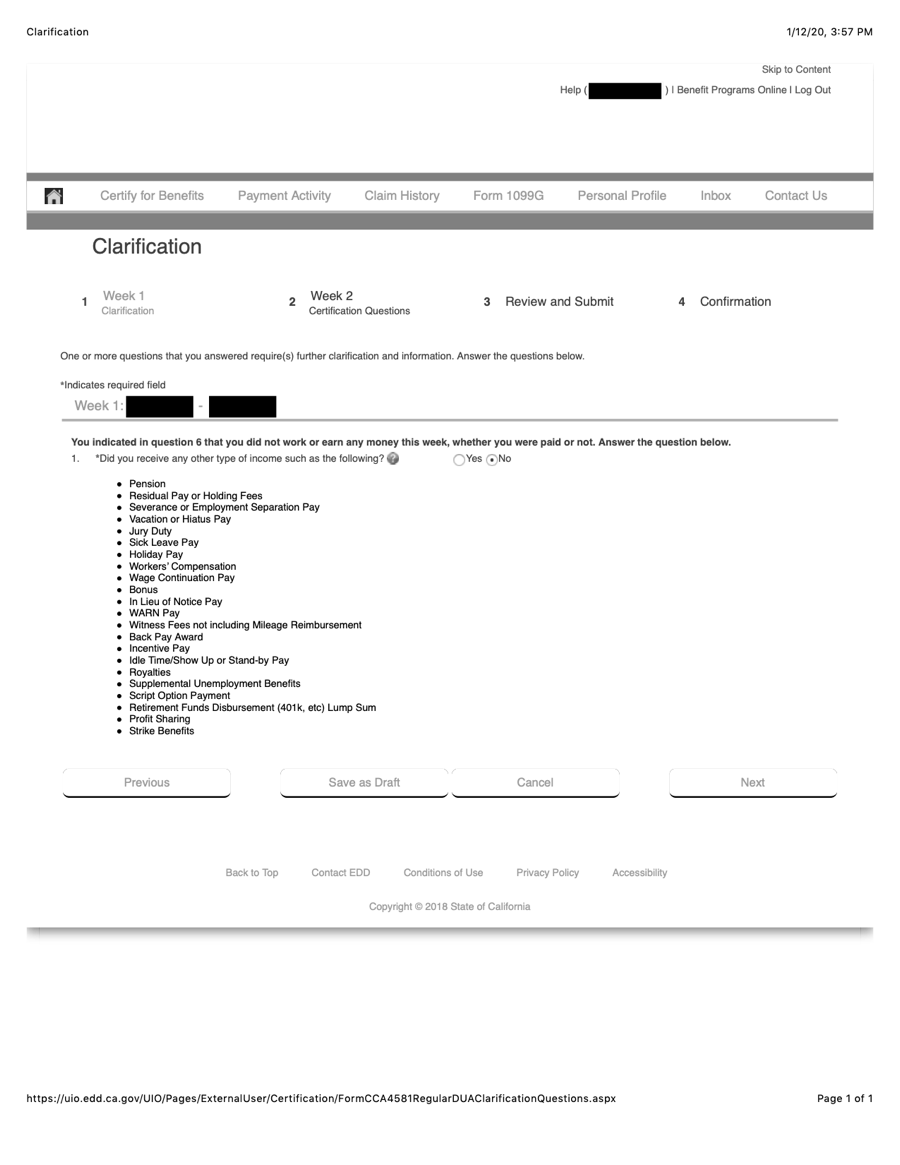

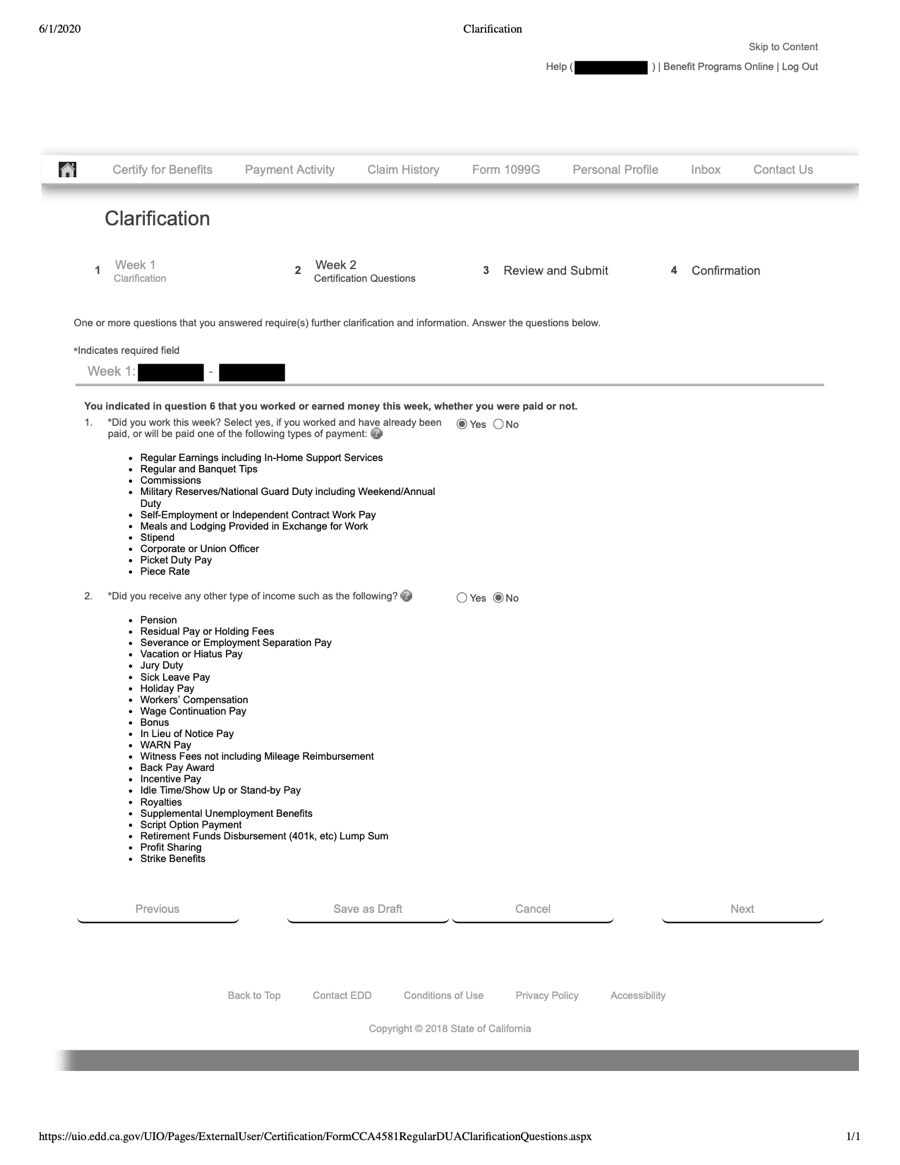

Clarification (for Week 1)

Figure 4:

- If you had any of the tyoes of income listed, you will need to select Yes. Otherwise, select No.

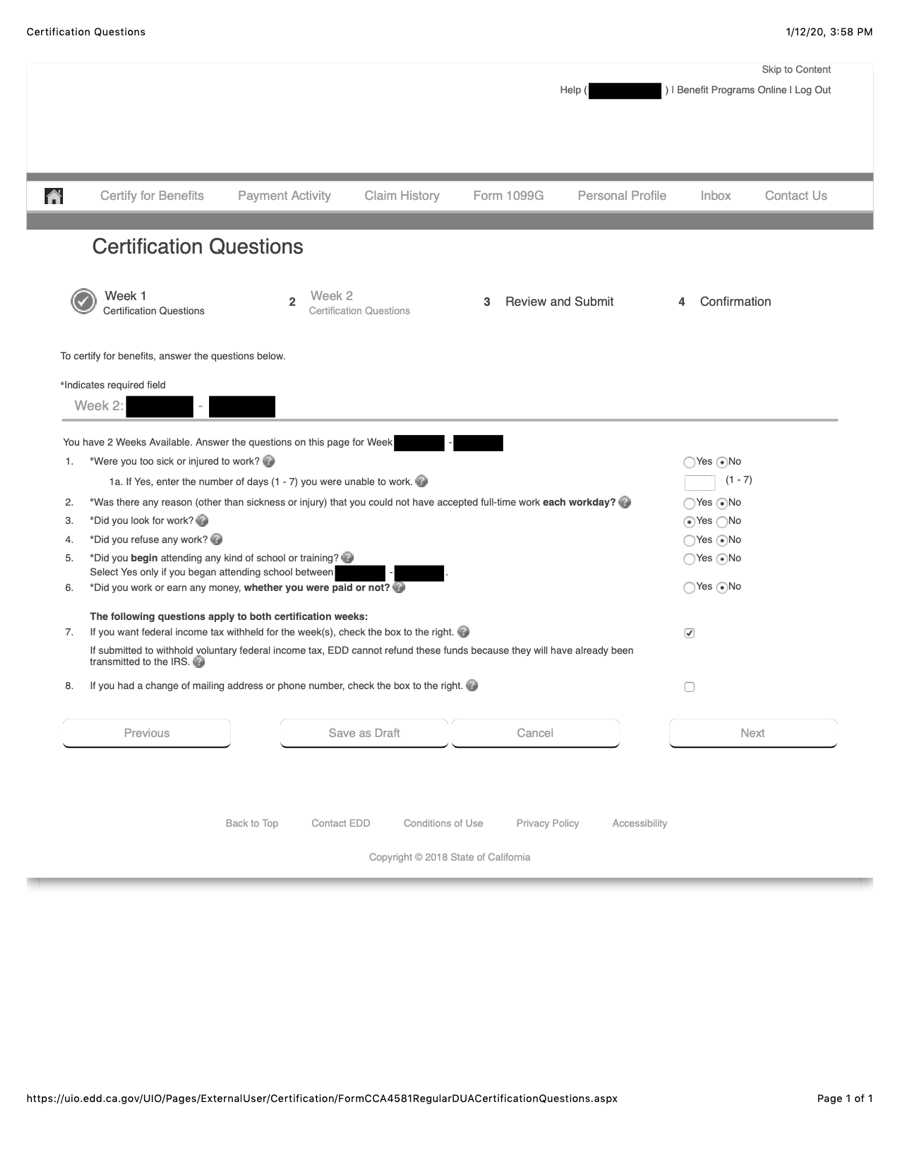

Certification Questions (for Week 2)

Figure 5:

- Assuming you did not work in Week 2, enter the information as shown above.

- If you did work during Week 2, see below..

- Put a check in the "If you want federal income tax withheld…" checkbox if you so desire (unemployment income is taxable income).

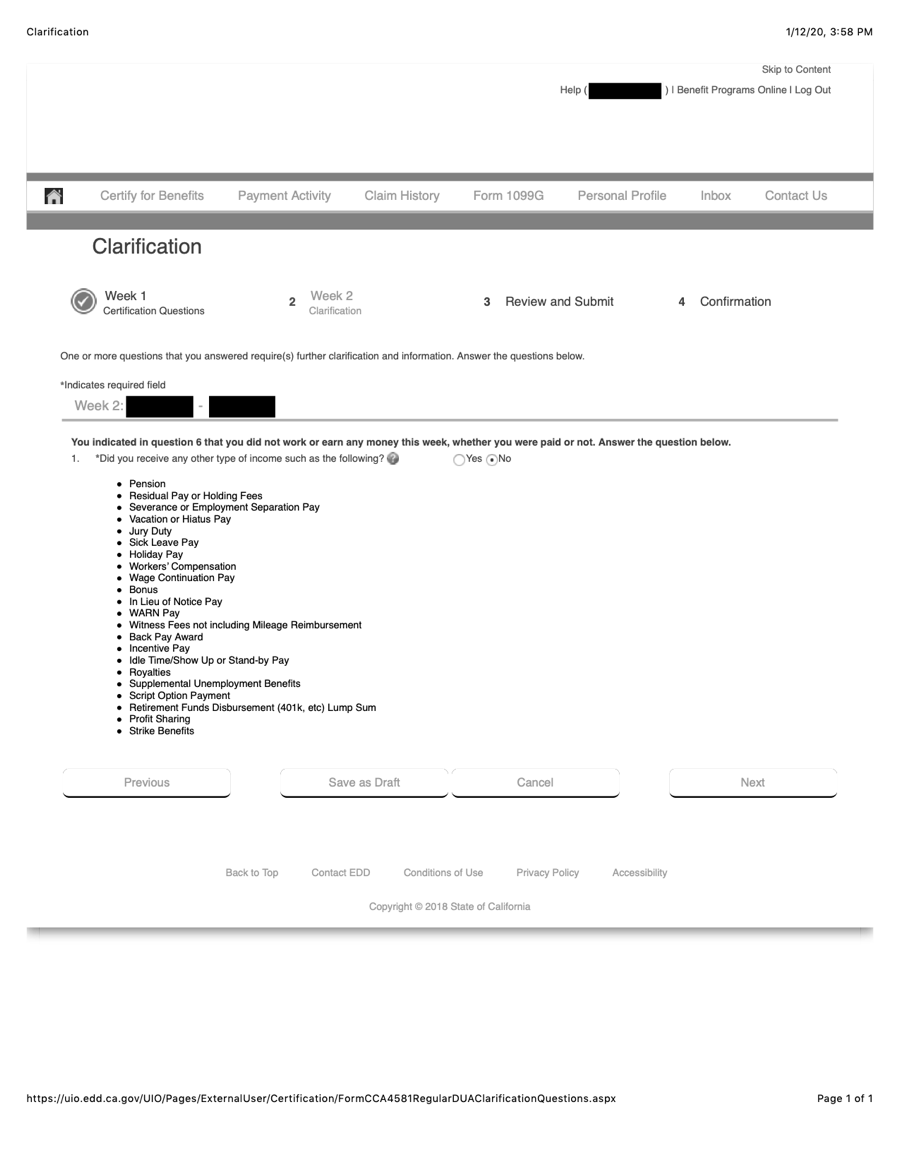

Clarification (for Week 2)

Figure 6:

- Q: If you had any of the tyoes of income listed, you will need to select Yes. Otherwise, select No.

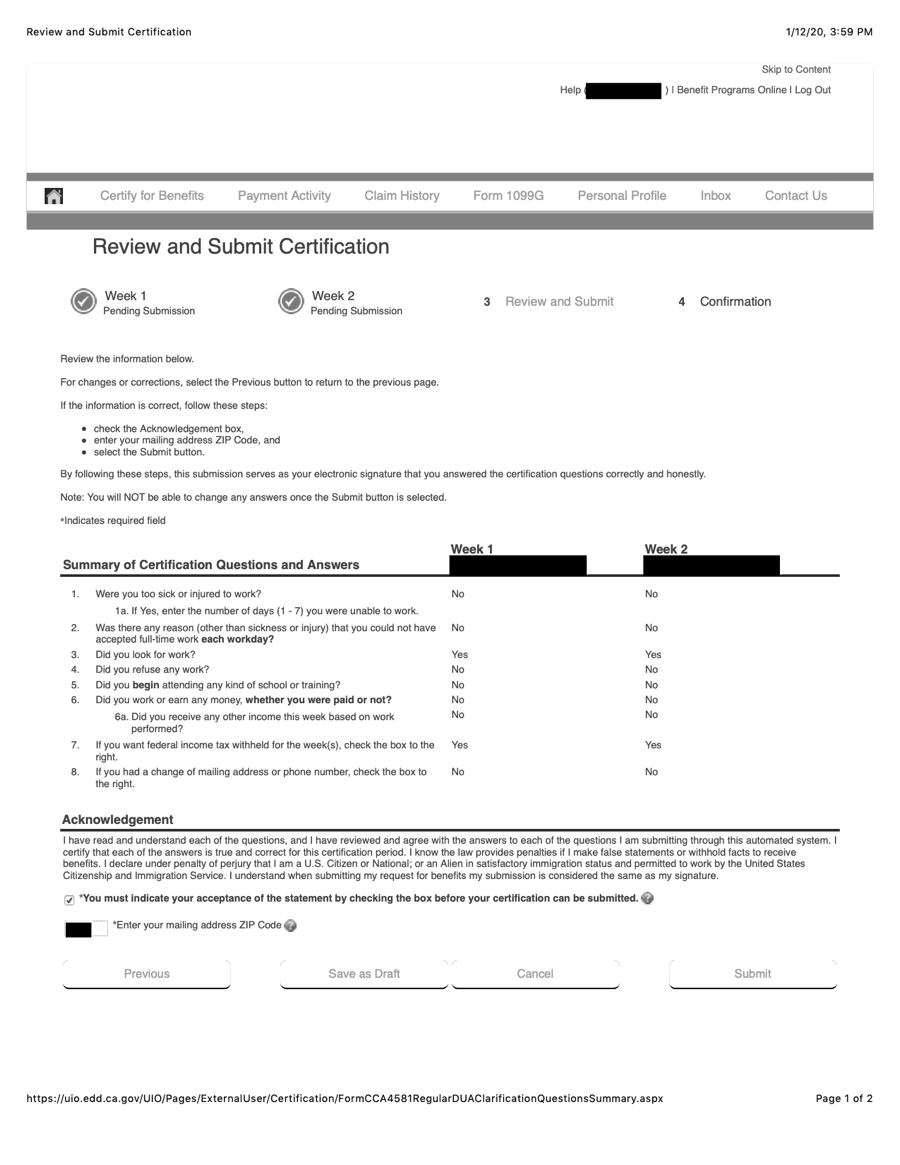

Review and Submit Certification

Figure 7:

- Double-check everything, and click the "Previous" button at the bottom of the form if you need to go back and correct anything (it would be a good idea to click the "Save as Draft" button first).

- Put a check in the Acknowledgement checkbox.

- Enter your mailing adress zip code.

- Before submitting your certification, save a copy of this page as a PDF, or print it out, for your records.

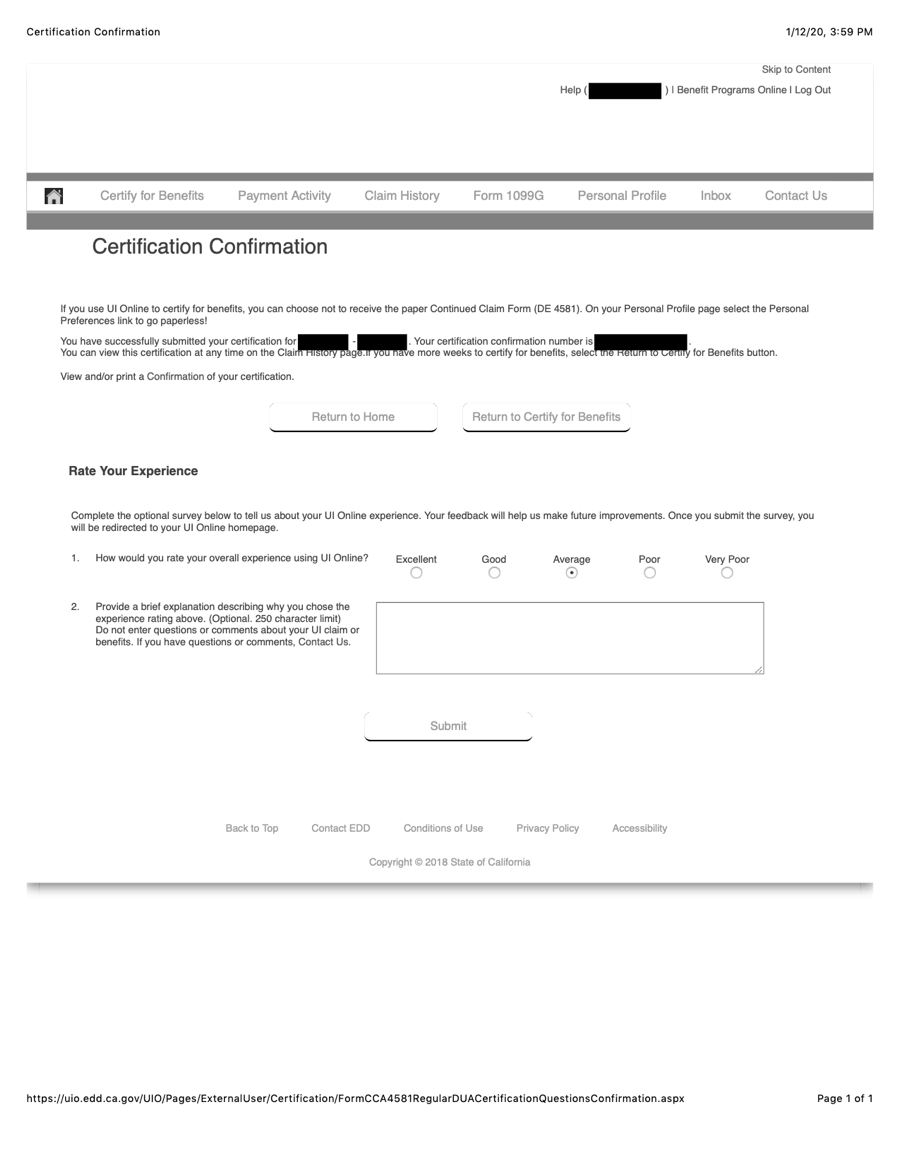

Certification Confirmation

Figure 8:

- You've filed!

- You may wish to save a copy of your certification confirmation number.

- Rate your experience.

If You Worked During One of the Weeks to Certify

Depending on when you filed your claim, the EDD may actually list that last week that you were still working as the first week that you can certify for benefits!

If you worked during one of the two certification weeks, you will need to declare that (remember that it doesn't matter when you are paid, it's when you performed the work that is important to the EDD). So when you get to the Certification Questions screen for the week you worked:

Figure 2w:

- Q: Did you work or earn any money, whether you were paid of not?

- A: Yes

Clarification (for the week that you worked)

Figure 3w:

- Q: Did you work this week? Select yes, if you worked and have already been paid, or will be paid one of the following types of payment

- A: Yes

- Q: Did you receive any other type of income such as the following?

- A: No [But if you had any of the types of income listed, you will need to select Yes to this question as well.]

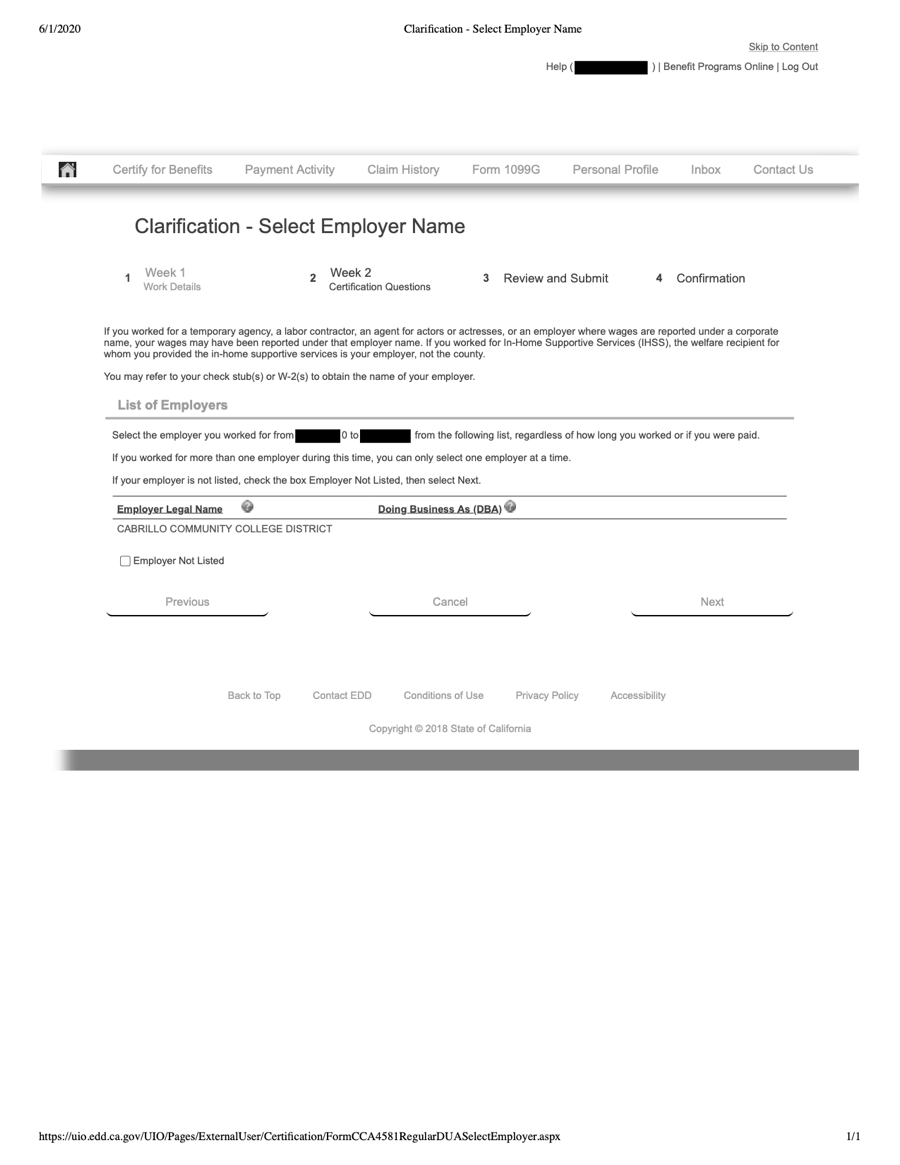

Clarification - Select Employer Name

Figure 4w:

- Your employer's name should appear here. Click on the employer's name that you worked for.

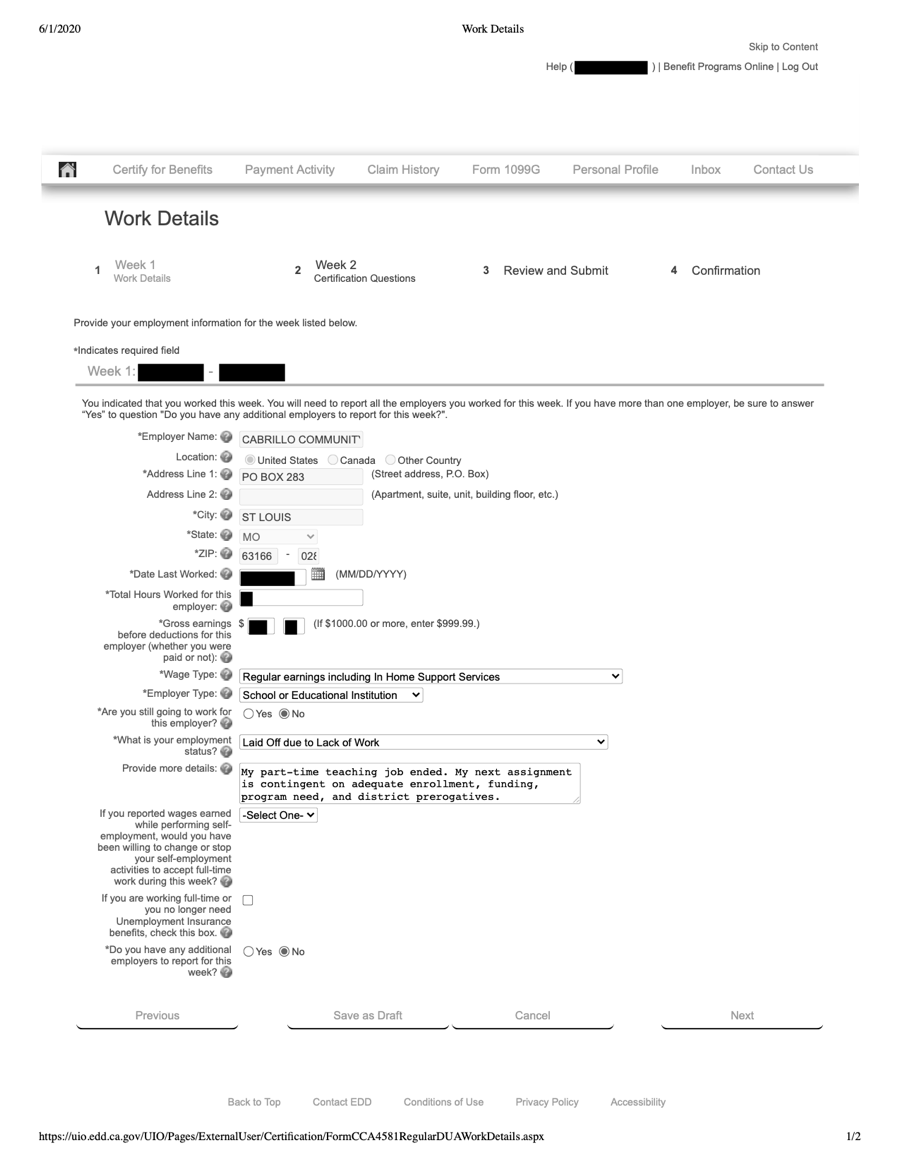

Work Details

Figure 5w:

- These fields will be populated with your employer's information. Click "Next".

[You may see your employer's address listed as being somewhere other than what you think is the correct address. That's OK. many districts use a third-party administrator for all EDD unemployment claims, and the address that appears may be one of their offices.] - Q: Date Last Worked:

- A: [The last day you worked for this employer in this week.]

- Q: Total Hours Worked for this employer:

- A: [There are many ways to calculate this, and they are all inexact estimates. You are the only one who knows how many hours you work per week. (Remember that your payment award will be based on how much you earned in your highest quarter of the last six quarters, and not on any of these figures, so don't stress about this.]

- Use this Earnings Worksheet.

- Q: Gross earnings before deductions for this employer (whether you were paid ot not):

- A: [Start with the gross amount of your last monthly check, multiply the amount by 12, and divide the result by 52. This is what you earned for one week.]

- Use this Earnings Worksheet.

- Q: Wage Type:

- A: Regular earnings including in Home Support Services

- Q: Employer Type:

- A: School or Educational Institution

- Q: Are you still going to work for this employer?

- A: No

- Q: What is your employment status?

- A: Laid Off due to Lack of Work [unless you are continuing to work]

- Q: Provide more details:

- A: My part-time teaching job ended. My next assignment is contingent on adequate enrollment, funding, program need, and district prerogatives. [Or, if you are continuing to work, explain that this is a short-term temporary assignment.]

- A: My part-time teaching job ended. My next assignment is contingent on adequate enrollment, funding, program need, and district prerogatives. [Or, if you are continuing to work, explain that this is a short-term temporary assignment.]

For the most current version of this document, see:

https://contingentworld.com/unemployment/unemployment_biweekly.php